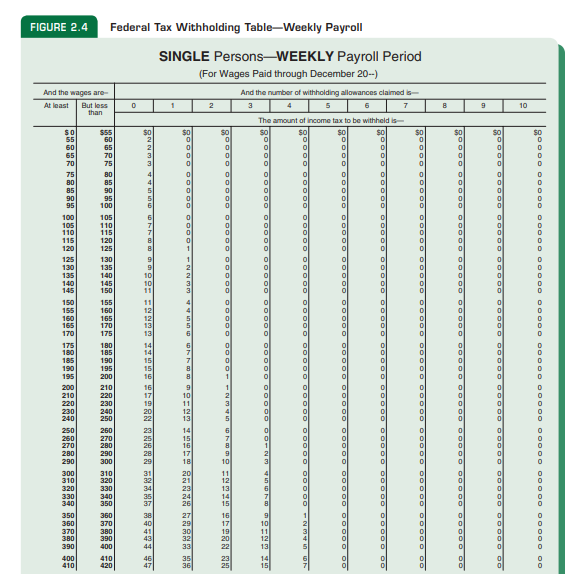

Solved) - Using the payroll tax withholding tables in Figure 2.3 and Figure... (1 Answer) | Transtutors

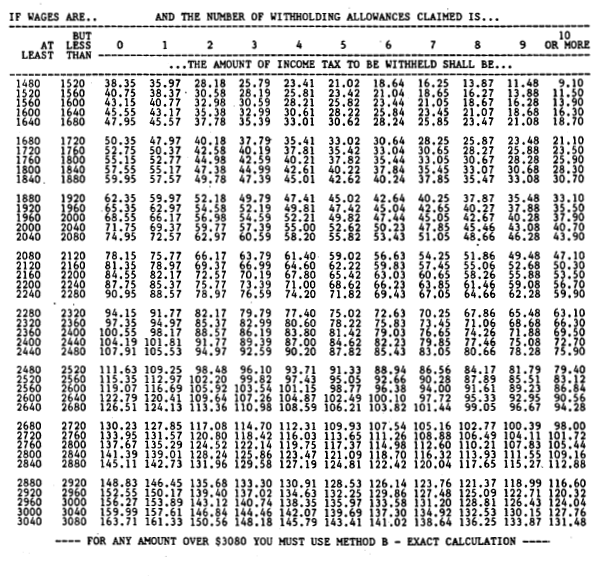

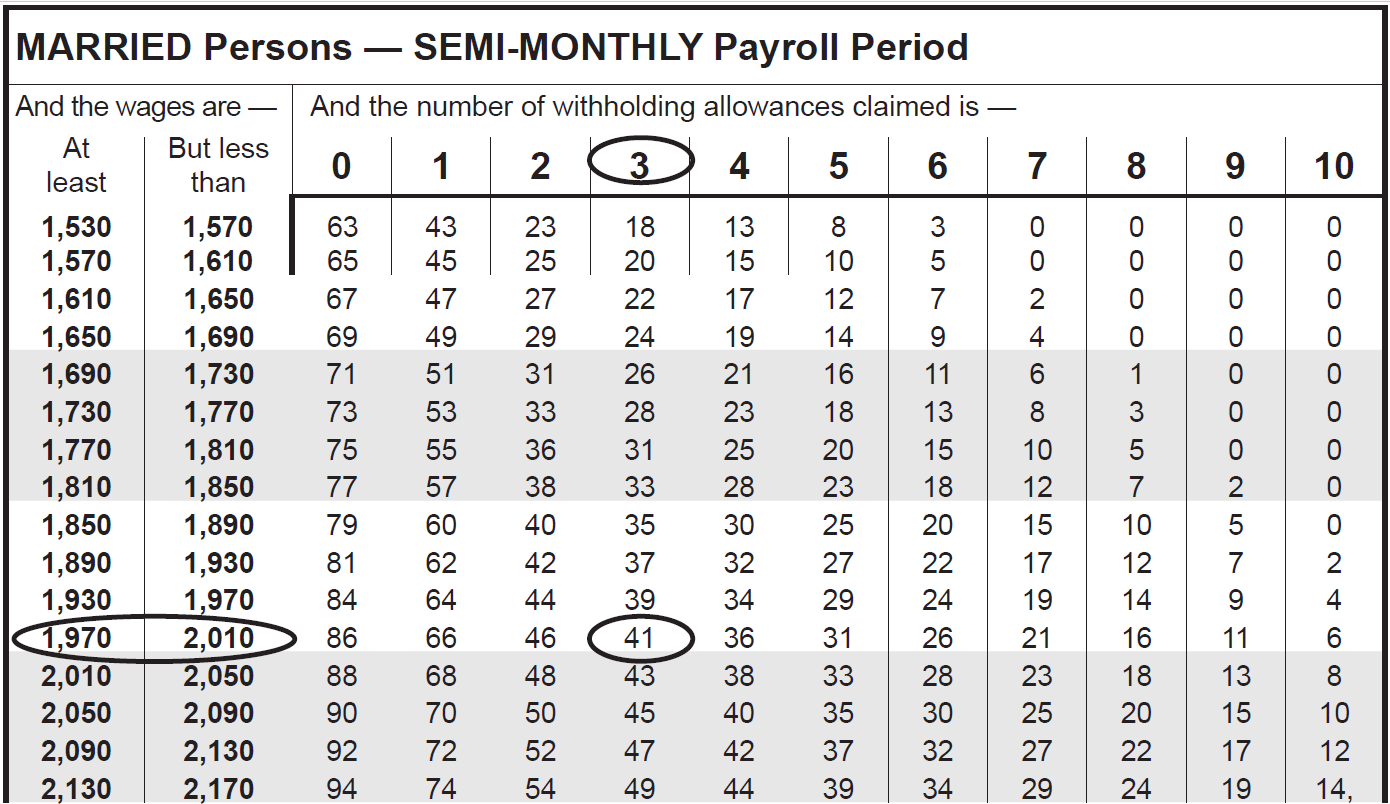

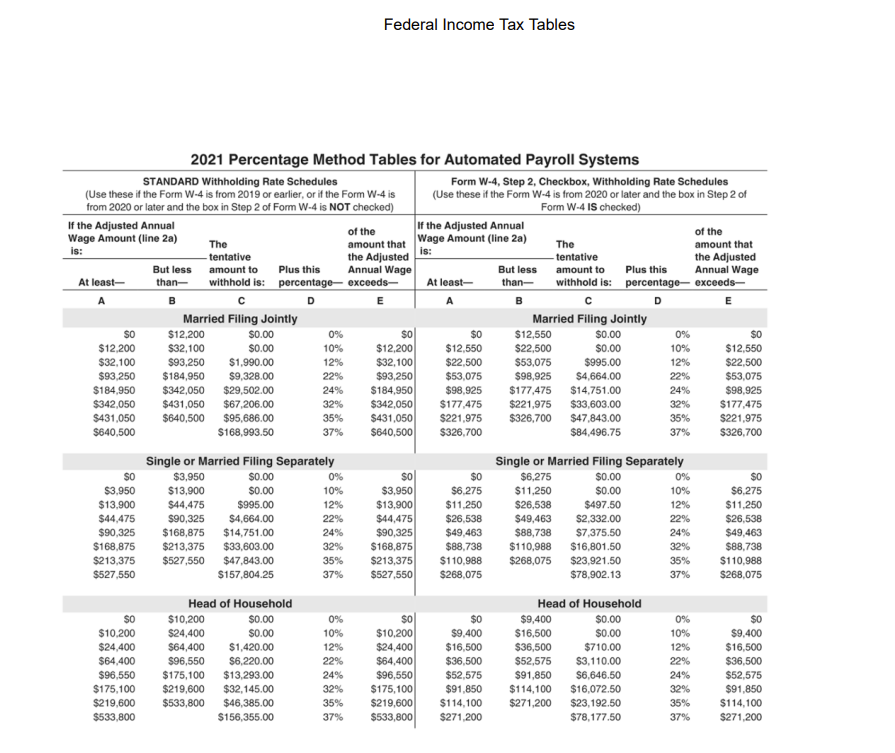

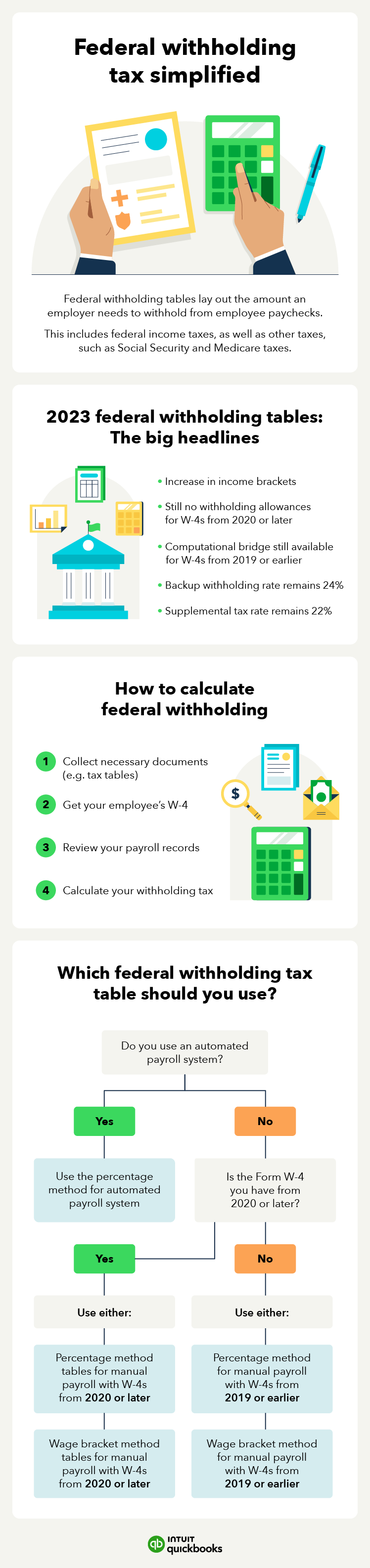

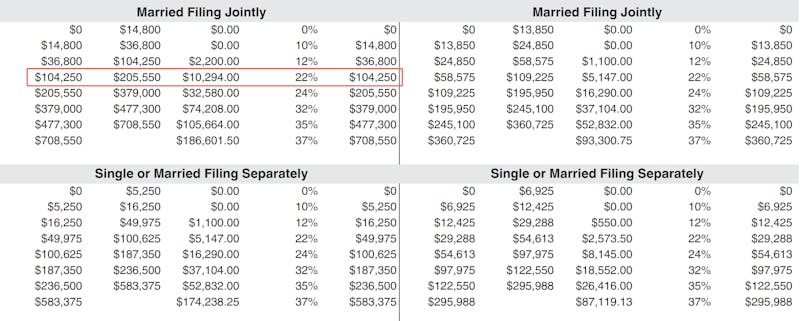

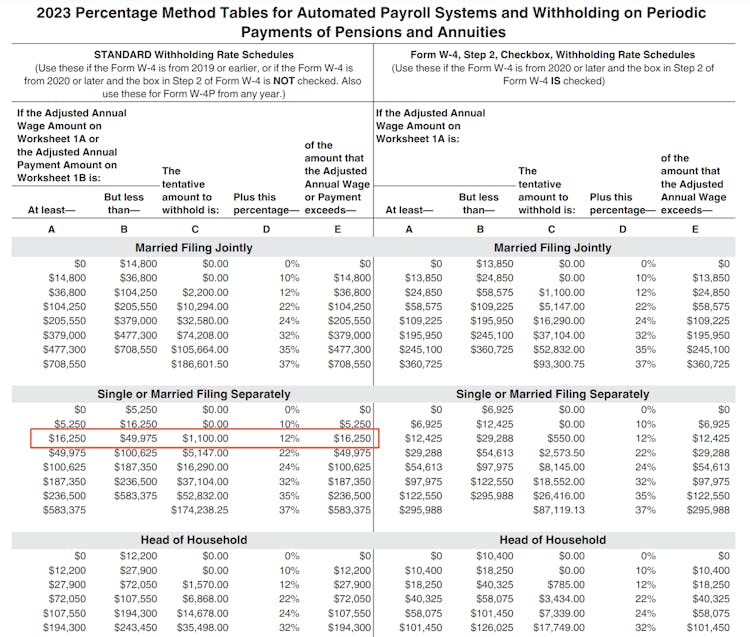

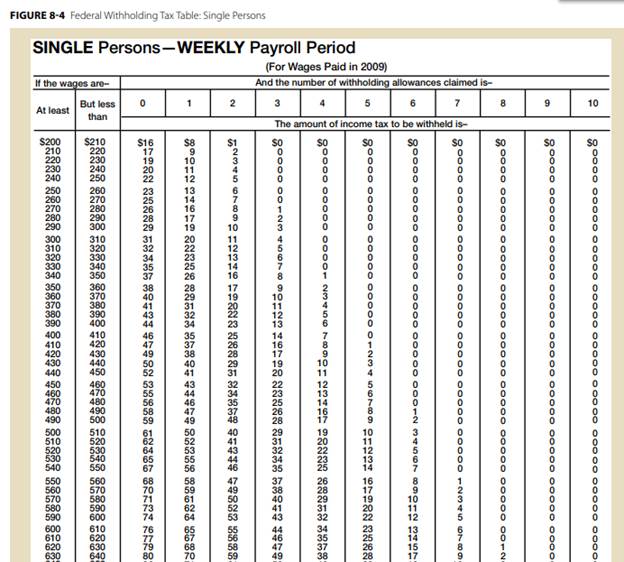

Publication 15: Circular E, Employer's Tax Guide; Chapter 16 How To Use the Income Tax Withholding & Advance Earned Income Credit (EIC) Payment Tables

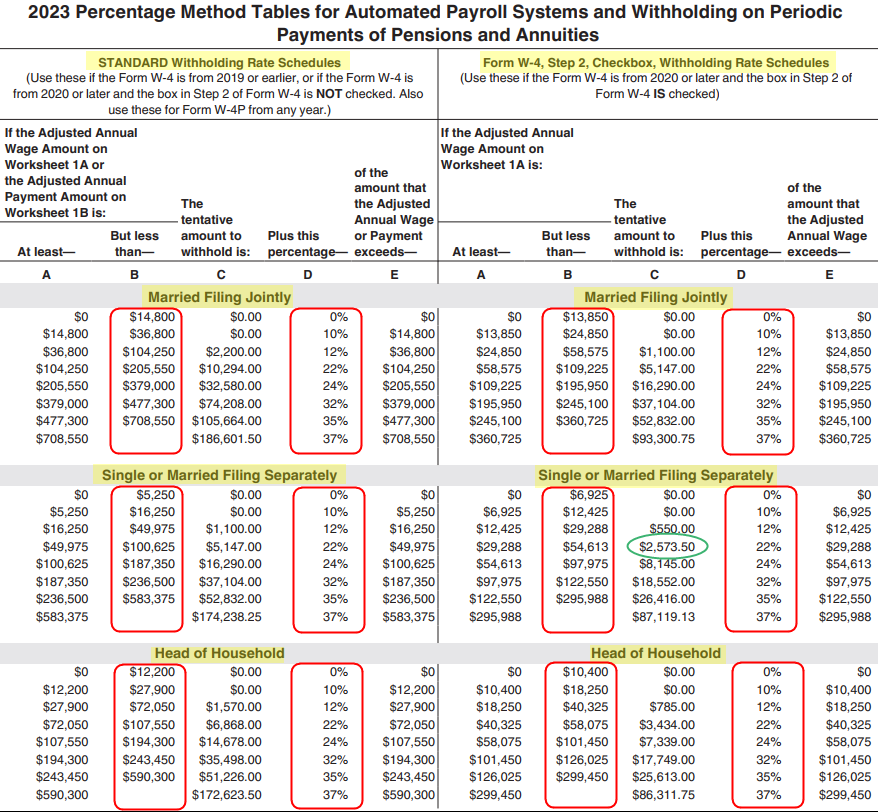

Publication 15a: Employer's Supplemental Tax Guide; Combined Income Tax, Employee Social Security Tax, & Employee Medicare Tax Withholding Tables

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/archetype/B7WJCXVGCZDX5ABOEQSHR3LMHQ.png)

:max_bytes(150000):strip_icc()/2022TaxTableExample-a04b9e0f21ae4f0080ae5017bba3cb7f.png)